The Texas Family Code uses a formula, typically referred to as the child support guidelines, to calculate how much child support an “obligor” (the person responsible for paying child support) should pay to the “obligee” (the person receiving child support). Usually, the obligee is the “primary” parent (the parent that has more possession time). This article is meant to be an overview of how the child support guidelines work in our state when one parent has more possession time than the other. For an explanation of how child support is calculated with an equal possession schedule, check out our blog article “Equal Possession and Child Support.”

Step 1 – Determine the Obligor’s Income

When calculating child support, you must first understand how much income the obligor earns monthly. The following sources of income are considered part of the obligor’s gross income:

- All income from wages and salaries and all other compensation for personal services (including commissions, overtime compensation, tips, and bonuses);

- All interest, dividends, and royalty income;

- All self-employment income;

- All rental income (excluding operating expenses and mortgage payments); and

- All other income actually received (e.g. pensions, trust income, capital gains).

These sources of income are not considered part of an obligor’s gross annual income:

- Return of principal or capital on a note not included in net resources;

- Unpaid accounts receivable;

- Benefits paid through Temporary Assistance for Needy Families;

- Payments for providing foster care; or

- Income earned by a new spouse.

Let’s say that Dave and his wife, Debra, are getting a divorce. They have two children together and no other children with anyone else. Dave is an accountant that earns $120,000 a year. That means Dave’s gross monthly income is $10,000 ($120,000 divided by 12 months = $10,000). $10,000 per month is the figure we need to use to proceed to the next step of the child support calculation (more on this below).

Step 2 – Determine the Obligor’s Net Resources

Once you know the obligor’s gross monthly income, you need to deduct certain items from that figure to obtain the obligor’s net monthly resources. The following items should be deducted from the obligor’s gross monthly income:

- Social Security taxes;

- Federal income tax (based on tax rate for a single person claiming one personal exemption and the standard deductions);

- State income tax;

- Union dues; and

- Expenses for health insurance coverage for the obligor’s child(ren).

Going back to our example with Dave the accountant. If you recall, Dave’s gross monthly income was $10,000. We now need to factor in the above items to find out what Dave’s net monthly resources are. Let’s say that Dave’s social security and federal income taxes equate to $2,000 a month (we will assume that Dave doesn’t have to pay state income taxes nor he is a union member). But, Dave does pay $400 a month for his children’s health insurance coverage. That means Dave pays a combined $2,400 a month in taxes and health insurance for the children. Next, we must subtract the $2,400 from Dave’s $10,000 of gross monthly income to get his monthly net resources, which would be $7,600 in this example. With this figure, we can proceed to the next step of the equation.

Step 3 – Using the Child Support Percentages

Once you know the obligor’s net monthly resources, you are ready to use the child support percentages set forth in the Texas Family Code to determine the monthly child support obligation amount. The percentage applied will depend on how many children the obligor has. Here are the child support percentages used by the court:

- One child = 20% of net monthly resources payable as child support;

- Two children = 25% of net monthly resources payable as child support;

- Three children = 30% of net monthly resources payable as child support;

- Four children = 35% of net monthly resources payable as child support;

- Five children = 40% of net monthly resources payable as child support;

- Six or more children = not less than 40% of net monthly resources payable as child support.

The above percentages are currently applied to the first $9,200 of the obligor’s net monthly resources (this is often referred to as the child support “cap”). What that means is, if the obligor has more than $9,200 in monthly net resources, the amount of child support paid, pursuant to the child support guidelines, is capped at the first $9,200. So, even if an obligor has monthly net resources in excess of $9,200, he/she will pay child support on just the first $9,200. The Texas legislature increases this monthly cap every six years to adjust for inflation. The current cap of $9,200 took effect on September 1, 2019.

Let’s go back to our example with Dave the accountant to show you how the application of the child support percentages works. Dave’s net monthly resources are $7,600. Since Dave and Debra have two children together, Dave could be ordered to pay 25% of his $7,600 in net monthly resources as child support to Debra (i.e. – $1,900 per month).

Now let’s say that Dave’s net monthly resources were exactly $9,200. Dave could be ordered to pay 25% of his $9,200 in net monthly resources as child support to Debra (i.e. – $2,300 per month). Even if Dave’s net monthly resources were more than the $9,200 cap, his child support would still be $2,300 per month because of the child support cap on net monthly resources.

Other Important Things To Know

While the above information is the typical way child support is calculated, there are variables that could alter the child support obligation amount.

If the obligee can prove his/her child has needs that require more child support than what the guidelines would provide, the court can order the obligor to pay more than the guideline child support amount. For example, a child with a disability might require financial assistance greater than the child support guidelines above. However, the court cannot award child support in an amount greater than the child’s proven needs. That means if the obligee can prove the child needs an additional $350 a month, the court would not be able to order the obligor to pay more than an additional $350 a month on top of the standard child support guideline amount.

The court may also deviate from the child support guidelines if it’s found that the guidelines would be inappropriate. The court can consider anything relevant when determining what is in a child’s best interest as it relates to potentially deviating from the child support guidelines. For example, the age and needs of the child (as discussed above), the ability of the parents to support the child, the amount of possession each parent has, and the financial resources available to the child are all things the court may consider when setting child support outside of the guidelines.

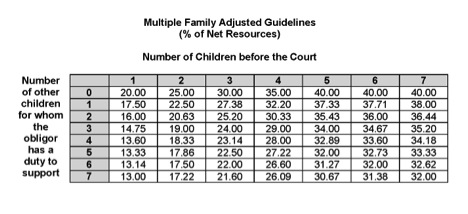

Something else that is very important to remember is, if the obligor has additional children with someone else, the court will lower the child support percentages used to calculate the child support obligation amount. Below is a chart that helps explain how the court will adjust the child support percentages based on the number of children that are involved in the case and how many other children the obligor has a duty to support.

Using our example with Dave, we originally said that he and Debra had two children together and no other children with anyone else. As such, Dave could be ordered to pay 25% of his net monthly resources to Debra as child support. But, what if Dave also had a child with his first wife, Sally? That would mean Dave has two children with Debra and one with Sally. Using the above chart, the court would reduce the percentage used to calculate Dave’s child support obligation owed to Debra from 25% to 22.5%.

Texas Attorney General Child Support Calculator

After reading all this, do you have more questions than answers? Don’t stress! Thankfully the Texas Attorney General has a calculator that will give you ballpark figure for child support – https://csapps.oag.texas.gov/monthly-child-support-calculator. The attorneys at Grinke Stewart Law can also help you better understand your legal rights and options as it relates to child support, call us today!